WINDHOEK, Oct 4 (The African Portal) – With the 2025 Namibia Financial Inclusion Survey (NFIS) underway, it is timely to revisit the 2017 baseline to assess how borrowing behaviour may have evolved.

A key finding from 2017 was that borrowing was overwhelmingly driven by short-term survival needs rather than long-term investments.

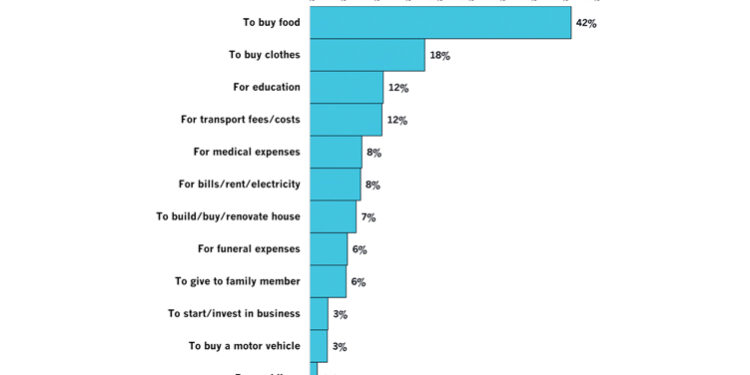

Respondents who had borrowed money in the six months preceding the survey were asked why, with multiple responses allowed.

The most common reason for borrowing or taking out a loan was to buy food (42%), far outweighing all other categories.

Furthermore, borrowing for clothes (18%), transport (12%), and medical or utility expenses (8% each) shows that for many, credit is more so a coping mechanism for day-to-day consumption rather than a means of building assets.

Housing (7%), business investment (3%), and motor vehicle purchases (3%) featured only marginally.

More recently, private sector credit extension data show households repaying overdrafts since the introduction of the new personal income tax brackets, further supported by declining interest rates.

In August 2025, overdraft credit to households contracted by 11.2% year on year.

At the same time, household uptake of longer-term and more productive forms of credit, such as instalment and leasing, has increased, with annual growth in August 2025 reaching its highest level since early 2015.

Thus, the composition of household credit has shifted following the tax bracket adjustments and over-deduction allocations.

Mortgage loan growth, however, remains weak, having failed to record annual growth of at least 1% since

November 2024.

Looking ahead, the momentum from the tax bracket reforms appears to have dissipated, with card transaction values and e-money transactions declining over the past six months or so.

This could raise concerns that short-term borrowing for consumptive and unproductive purposes may rise again.

Unfortunately, the personal income tax brackets were intended to be adjusted annually for inflation creep, but this has been postponed to the next financial year, putting additional pressure on taxpayers’ spending power.

Credit: The Namibian